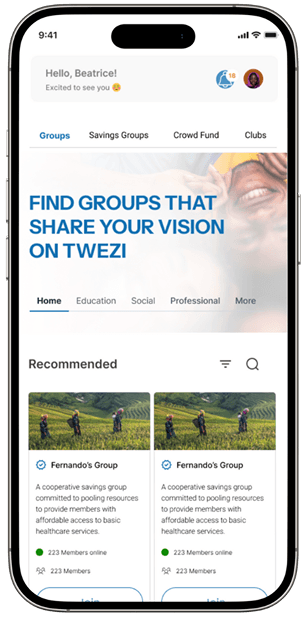

Twezi makes managing groups, contributions, and events effortless—everything you need, all in one seamless platform.

UGX 15,560.00

James Just Contributed $10k to Benevolent Fund

Grace Just Contributed $10k to Benevolent Fund

Effortlessly manage your Group Savings, Benevolent Funds, and Social Fundraising with Twezi.

Streamline your operations, enhance transparency, and empower your community to achieve more. Take the first step.

Bring your family and friends together seamlessly. Manage members, activities, and goals—all in one place.

Reach your financial goals as a team. Track savings effortlessly and stay on target.

Launch campaigns that inspire action. Crowdfund for your projects with confidence and transparency.

No more chasing members for payments. Automate subscriptions and renewals for hassle-free management.

Stay connected to life’s big moments. Get reminders for birthdays, anniversaries, and milestones.

Ease financial burdens, bring people together, and support loved ones when it matters most. Simplify contributions, ensure transparency, and offer care with ease.

Connect with your past. Build your family tree and preserve your heritage for generations.

Book a Demo or show interest